ALDI in Australia is the first Australian retailer to launch a carbon footprint label in its stores, with its everyday olive oil range. The New Zealand Wine Company is pioneering the use of the Carbon Reduction Label to communicate the carbon footprint per glass serving of its Mobius Marlborough sauvignon blanc. When you consider that around 12 million loaves are sold each day, the effect is of efficiency gains is quickly magnified. It is the first bread brand to use the Carbon Reduction Label. Kingsmill has measured the carbon footprint of three of its most popular loaves and based on that data is now targeting a cut in carbon emissions of 20%. One example of a brand that is addressing these new market trends is Kingsmill. BrandZ, the corporate reputation study carried out by Millward Brown, has calculated that on average about 20% of sales are influenced by corporate reputation, with environmental reputation directly influencing about 2% of all sales. Efficiency gainsīusinesses are investing in understanding their supply chain emissions, verifying the carbon footprint of their products and communicating with their customers because they can see the potential for consumers to switch to lower-carbon alternatives and the huge value at stake. The Centre for Retail Research predicted that sales of products with carbon labels will surge to £15.2 billion by 2015.

The Carbon Reduction Label shows the product's carbon footprint - enabling choice - and highlights an ongoing commitment to reduce that footprint. In the UK the Carbon Trust's Carbon Reduction Label is used on hundreds of products, including brands like Dyson and Tesco, with an estimated combined sales value of over £2bn.

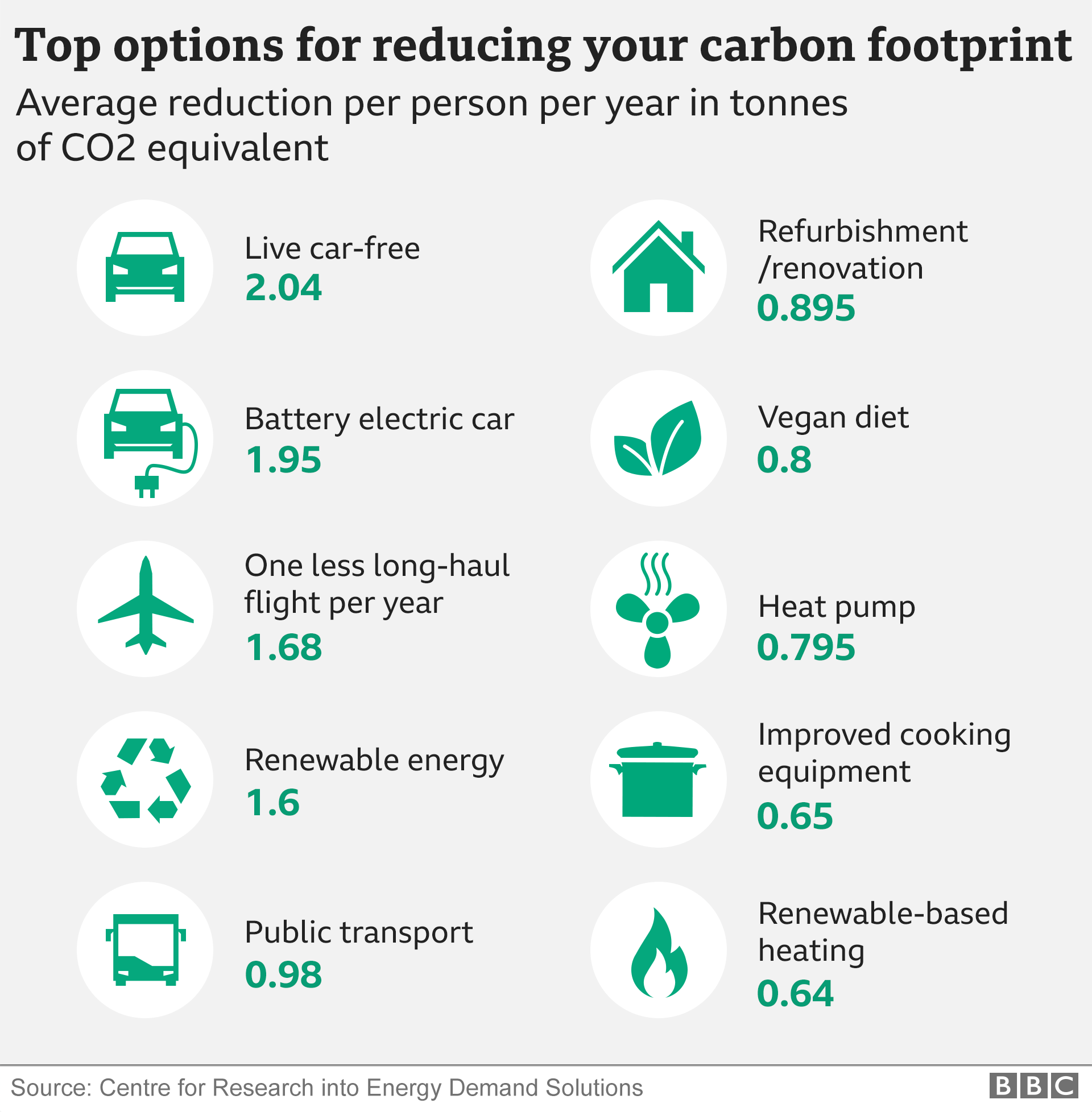

Perhaps surprisingly despite the challenging economic climate one in five people would choose carbon labelled products over non-labelled products even if they cost more. When asked whether they would buy carbon labelled goods over non-labelled goods of identical quality, 47% of people were more likely to choose those with a label. This demand for information is creating a new market for carbon labelled goods. Demand for carbon labellingĪgainst this backdrop consumers want businesses to help them make environmentally aware choices and reduce their personal carbon footprint when they shop. A quarter (24%) would consider taking fewer overseas holidays. Our research also shows that a large percentage of people are prepared to make lifestyle changes to reduce their impact on the environment, if they don't have to pay more: 70% said they would follow simple energy-saving advice on product packaging to reduce their carbon footprints. Brand loyalty is also at stake - 56% of people would be more loyal to a brand if they could see at a glance that it was taking steps to reduce its carbon footprint. This rate has doubled over the past year from 22%. Our research revealed that 45% of shoppers would be prepared to stop buying their favourite brands if they refused to commit to measuring their product carbon footprint. The Carbon Trust recently conducted research into consumer buying habits. Leading businesses are responding to these changes, by measuring and reducing their impact and engaging their customers in the debate. Increasingly they are prepared to change their shopping habits to help minimise this 'embodied carbon' or 'carbon footprint' associated with their purchases. People understand that the manufacture, distribution, sale and disposal of the products they buy come at a high price in terms of carbon emissions across the supply chain. Consumer demand for lower-carbon products and services is growing, despite the tough economic climate.

0 kommentar(er)

0 kommentar(er)